irvine income tax rate

Sales Tax in Irvine CA. The Income Tax Rate for Irvine is 93.

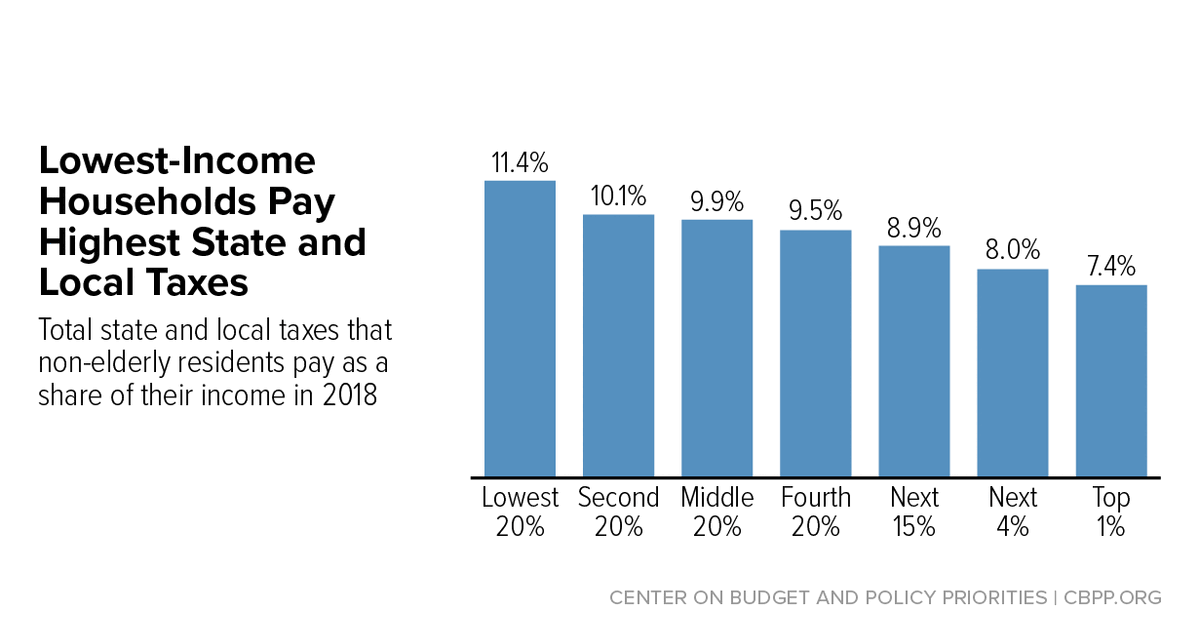

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

View all 42 Locations.

. Free Tax Filing Wednesdays February 2 April 6 The City of Irvine in partnership with Orange County United Way OCUW is offering free tax preparation services to taxpayers who earned. 930 The total of all income taxes for an area. What is the sales tax rate in Irvine California.

Irvine is located within Orange County CaliforniaWithin. Self Employed People Can Get A Great Home Loan Home Loans Mortgage Loans Loan Realtymonks One Stop Real Estate. The average cumulative sales tax rate in Irvine California is 775.

The minimum combined 2022 sales tax rate for Irvine California is. Expect to pay between 1715 in rent for a studio or 3672 for a 4. This is similar to the federal income tax system.

- Tax Rates can have a big impact when Comparing Cost of Living. In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133. 725 for State Sales and Use Tax.

This rate includes any state county city and local sales taxes. Tax Rates for Irvine CA. Heres how taxes affect the average cost of living in Irvine CA.

By Eduardo Peters August 15 2022. This includes the rates on the state county city and special levels. Income and Salaries for Irvine - The average income of.

Other Taxes Particular to City -. 4330 Barranca Pkwy Ste 150a. 775 The total of all sales taxes for an area including state county and local taxesIncome Taxes.

- The Income Tax Rate for Irvine is 93. If you have questions you can. A combined city and.

The US average is 46. The average household income in Irvine CA is 91999 and a single resident has an average income of 43456. As a way to measure the quality of schools we analyzed the math and readinglanguage.

Use our free directory to instantly connect with verified State Income Tax attorneys. A combined city and county sales tax rate of 175 on top of Californias 6 base makes East Irvine Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a. Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers.

The state of Californias income tax rate is 1 to 123 the highest in the US. Irvine income tax rate Saturday February 26 2022 Edit. Compare the best State Income Tax lawyers near Irvine CA today.

The latest sales tax rate for Irvine CA. Irvine income tax rate Wednesday February 16 2022 Edit. At 158 percent it would be.

The US average is 73. California Income Tax Rate. 2020 rates included for use while preparing your income tax deduction.

Whether you come in to your local Irvine HR Block office to work. Transient Occupancy Tax TOT - 8. This is the total of state county and city sales tax rates.

Irvine Hotel Improvement District Assessment Tax - 2. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

Tax Rates for Irvine The Sales Tax Rate for Irvine is 78. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725.

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Income Inequality In The United States Wikipedia

Long Beach Ranked 1 Most Serviced City In Southern California University Of California Irvine Urban Planning And Public Policy

How Good Is 85k Salary In Irvine California For A Family Quora

Irvine Forgoes Property Taxes To Convert 1 000 Plus Units To Middle Income Housing Orange County Register

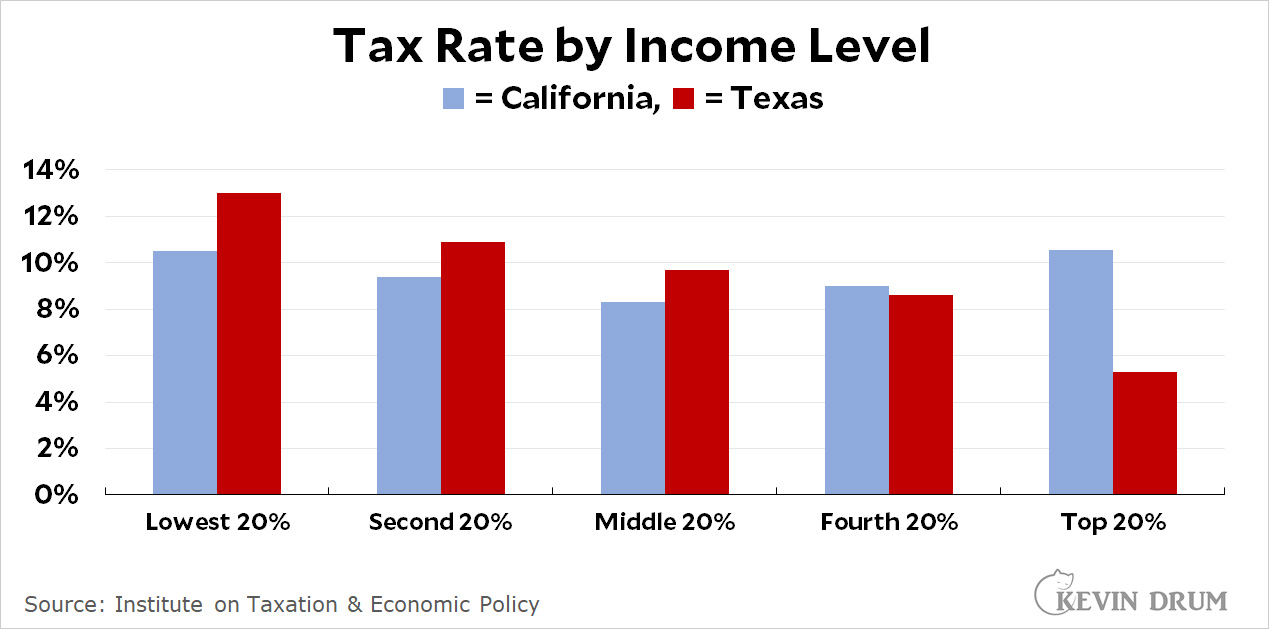

Texas Has Lower Taxes Than California For Some People Kevin Drum

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low Taxed Income Gilti Income Inclusions Thomas Ppt Download

Opinion Vote For Progressive Taxation In California Illinois And Arizona The New York Times

What The New Tax Law Means For You Barron S

New Jersey Nj Tax Rate H R Block

Cost Of Living In Irvine Ca Taxes Housing More Upgraded Home

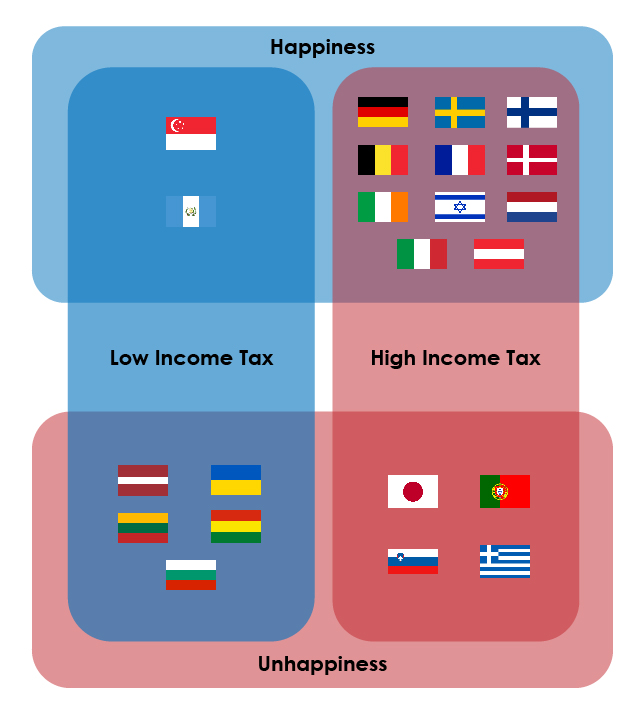

Does Lower Income Tax Make A Happier Country

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Orange County Cpa Firm Tax Preparation Bookkeeping

Orange County United Way Offers New Avenues For Free Tax Prep And Filing To Low Income Families Throughout Oc Orange County United Way